We’re simply at the dawn of a new technology that’s widely misunderstood, and we just don’t yet know what impact it will have. That’s why you don’t want to get swept up in sudden changes like McDonald’s, IBM, and Klarna, who fired employees only to rehire them along with consultants who specialize in cleaning up what AI generated. Nor do you want to allow every team in your company to inject AI into what they are building.

“AI” is, of course, not a feature any more than “software” is a feature. As CFO, you must be skeptical of any vendor’s AI claims and hold them to the razor of logic: If a feature exists, let me see it. And if it works, show me how.

In this guide, we offer four questions your office should be asking of every software partner making AI claims. Some vendors will noisily object. But remember, the truth doesn’t mind being questioned.

Four questions to ask:

1. How do you ensure the AI is accurate and consistent enough for financials?

At the time of writing, ChatGPT cannot reliably stick to a word limit or perform basic arithmetic. Recent reasoning and memory updates have improved these models somewhat, but it’s important to understand that hallucinations and imprecision are a feature and not a bug. They are why AI works. LLMs use transformers to reduce text into tokens and understand their semantic relevance in a way that mimics human thinking. They combine the user’s domain-specific knowledge with all the public knowledge they have access to, which allows them to make connections that prior generations of AI models couldn’t.

It’s why the models can sometimes flub arithmetic but nevertheless generate a useful analysis of, say, SEC filings.

These details matter because they help you understand where these models can and cannot add value, and where each LLM tends to source information from. Until recent changes, using a generic consumer LLM in your ERP was tantamount to inviting the good people of Reddit and Wikipedia into your decisions.

This is why you should worry when an ERP vendor tells you that they are just a neutral repository of information. If they say, “Apply any outside model to any part of the business process,” they are allowing your users to introduce risk and make potentially substantial mistakes. They will generate wrong numbers and reports that change each time you run them. Just ask Deloitte.

But AI doesn’t have to work this way.

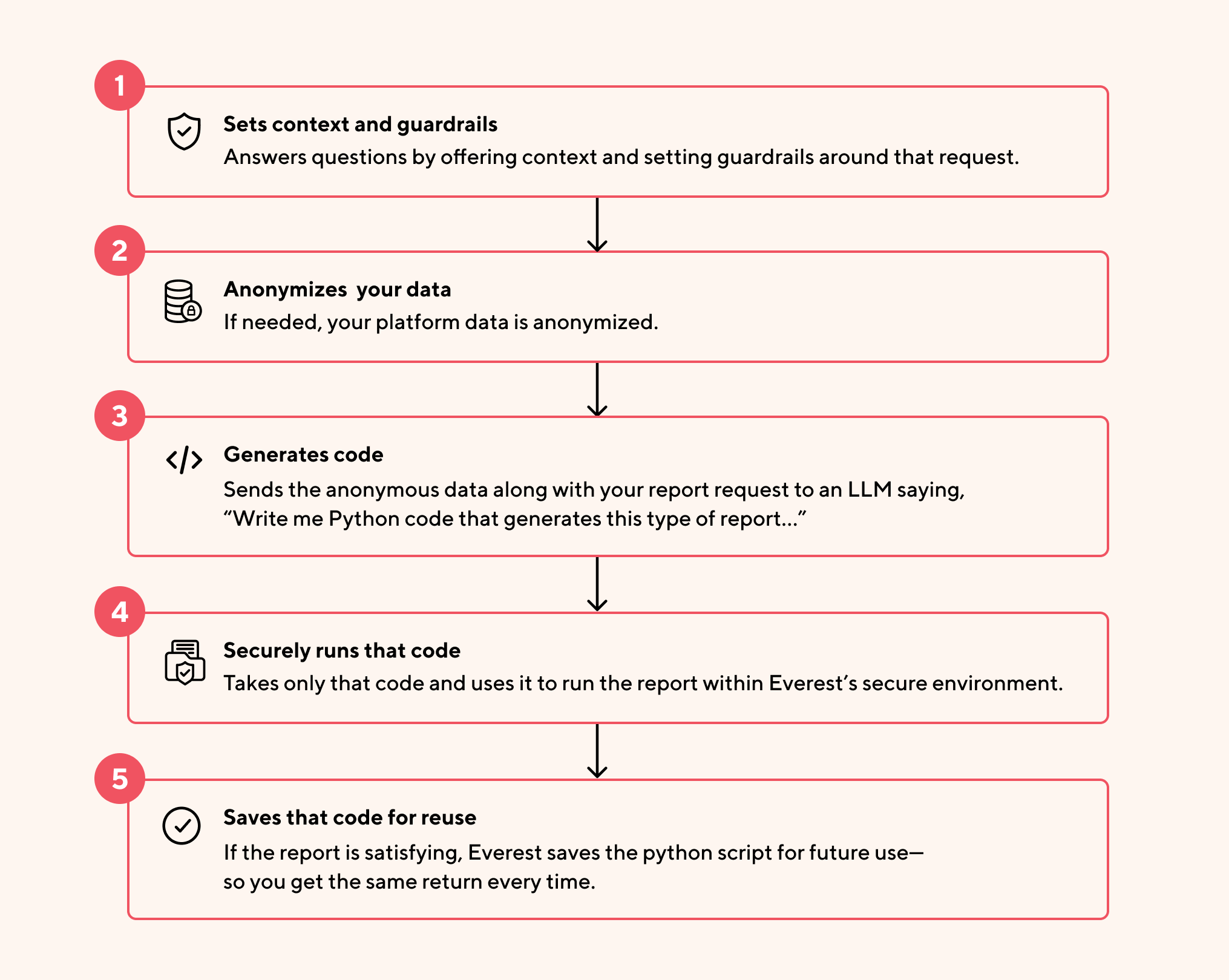

At Everest, we’ve solved for this by applying LLMs where they are useful and restricting them where they are not. When you build an AI agent in Everest to create a report, that agent doesn’t just query a consumer-grade LLM. Instead, it:

This system puts LLMs to their highest use. It never exposes your data, your report will run the exact same every time, and you aren’t paying AI usage credits every time you refresh it. You now own the code.

2. Why can’t this be done without AI?

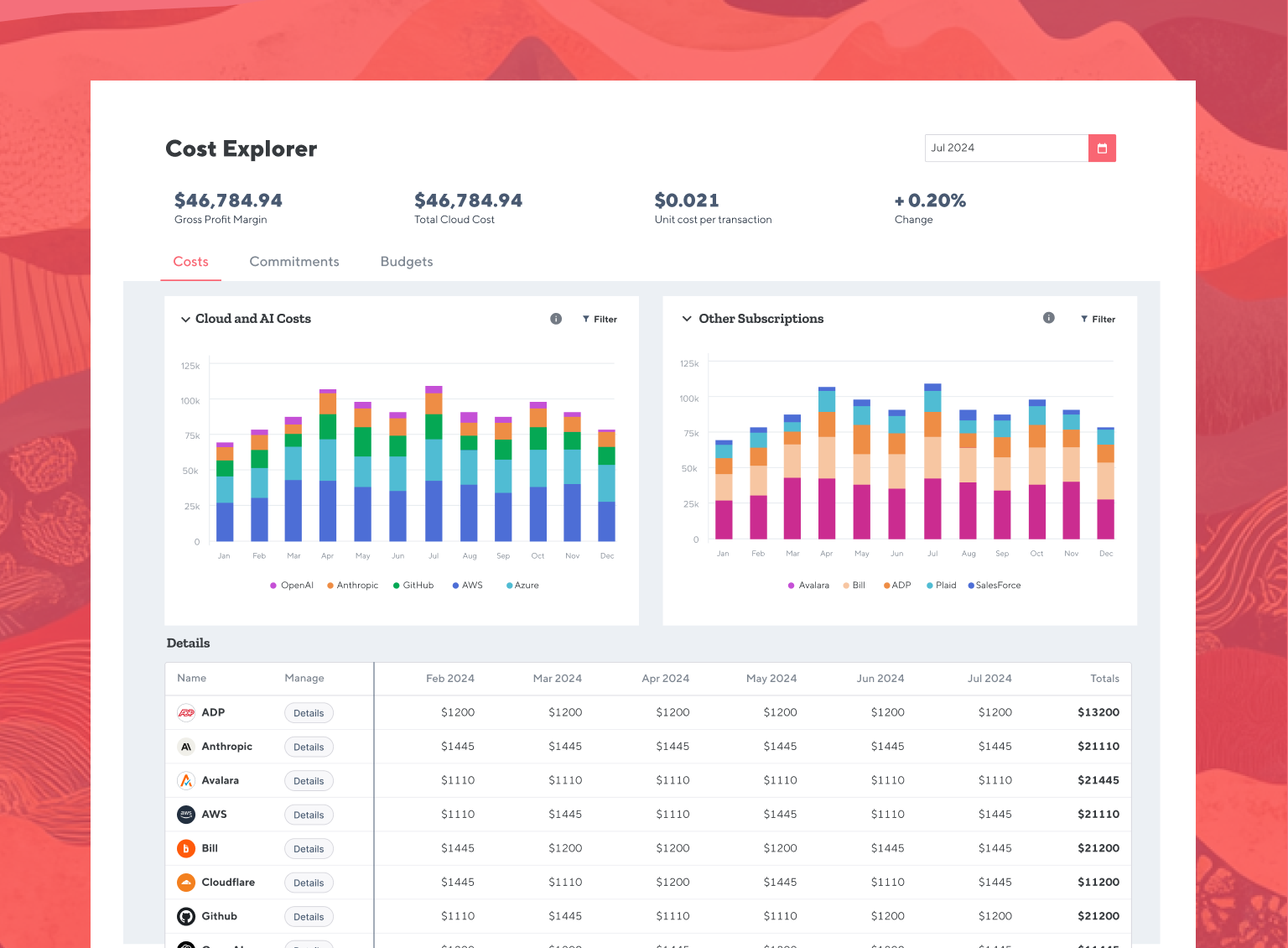

Cloud costs are skyrocketing, and venture capital and private equity money have depressed AI tool subscription prices to get companies addicted to its use. Perhaps you find my candor shocking, but that’s the playbook, and the next step is for LLM vendors to raise their rates.

If your cloud costs are high now, wait until you factor in the cloud costs of AI usage within your cloud costs. Which begs the question: What are your cloud costs today? I see CFOs who question every $20 travel expense but, for some reason, let everyone buy unlimited software, and who don’t know their current cloud-adjusted unit economics. Nor can they forecast those cloud costs.

We recommend only buying AI-powered features and tools for a discrete and definable purpose:

What is the problem statement this purchase solves?

Is it a fixed or recurring cost?

How will this cost grow over time?

Does the AI component increase the cost? If so, by how much?

Do you need to use AI every time you "execute" an action or only in "build" mode until you've got the desirable definition of the inputs? There are good uses for both (the system should be designed for both).

Every CFO today must be tracking and forecasting cloud costs so they can identify spikes and ensure their product or digital team isn’t building AI features of questionable utility into their product. Nor their go-to-market nor other parts of their business. Because any vendor who cannot explain what value the AI adds, may themselves not know, and may be accidentally increasing your cloud costs for no reason.

3. What tools do you offer that allow me to de-risk using AI?

If you do permit AI use within your ERP, billing, general ledger, or other core applications, you must also provide the tools to ensure it doesn’t cause harm. For the same reason you wouldn’t give a contractor administrative permissions over your ERP, or allow someone to push a major update without a way to roll back those changes.

I talk to VPs of finance and accounting who feel that their organization is afraid to hit “publish” on reports or transactions because they don’t know what ramifications it will have. They can’t be sure how their updates will overwrite important journal entries or modify already-closed books. Because there are multiple layers at which your team manages your financial software.

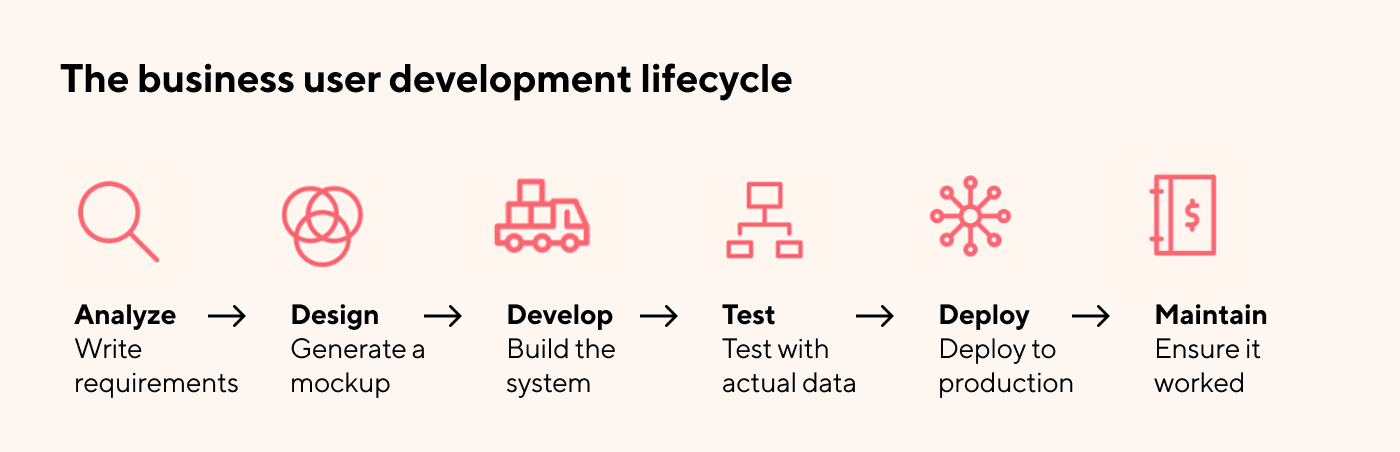

There is a splendid existing framework for this—the software development lifecycle. And as AI makes business users more technically savvy, those business users can apply the same principles. It’s the same rigor, now in the hands of business users.

Your financial operations team needs to be able to manage this project just like developers would. You need governance over the architectural layer that is both flexible and enduring:

Flexible: Your team has the ability to adjust objects, fields, and components in the natural order of work.

Enduring: Your team needs the ability to preview changes, run tests, and roll back if they encounter errors.

There’s really no way to do the above except with live sandboxing. This is when your team can create multiple staging environments or “sandboxes” where they can preview proposed changes using actual production data before pushing anything live. So instead of deferring, waiting, and fretting, they publish changes, move on, and are able to support the business.

4. How will you help us build out the functionality of the ERP ourselves?

At the speed things are moving, your team cannot afford to wait on IT. Nor can they work out of spreadsheets for six months while they evaluate additional bolt-on software to extend that ERP’s functionality.

For a common example, look at when companies try to launch subscription or usage-based billing. If you purchase a tool like Zuora to supplement your existing ERP, you also have to factor in the added complexity, including:

The time cost of managing it.

The change cost of training the organization.

The cloud cost of yet another subscription.

The integration cost of ensuring the data matches.

The professional services and IT costs of any custom code.

The maintenance cost of a fragmented finance stack.

This is just one application and just one example. If your finance operations team is being asked to support new company initiatives—if your business is considering usage-based billing, a re-org, an international launch, an acquisition, or virtually anything that shows up on the P&L—they need the ability to edit the ERP themselves.

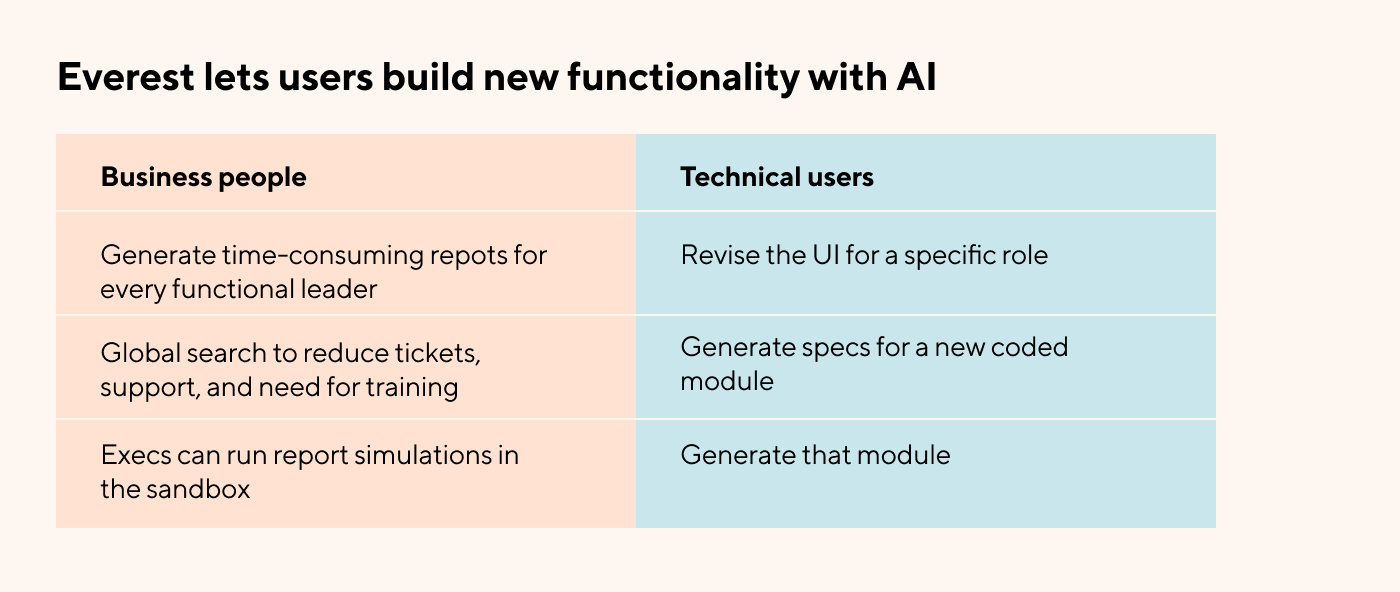

One way Everest is solving this problem is by allowing your team to chat with a secure AI model within the ERP to customize it. This can happen on two levels: Business users can chat with our AI to build reporting, which doesn’t require technical resources, and power users and IT can build full applications from scratch.

And Everest users can do this within a secure sandbox environment where they can fully test that the change works, with an approval process before it goes into production.

CFOs should be skeptical of AI claims

Far too many software today are “AI wrappers,” or software with a friendly interface that simply repackages consumer-grade LLMs. You can quickly identify these by asking about the team’s expertise and investment.

For example, and this is where I will close things out, Everest has raised $140 million to date and spent four and a half years stealth building a complete ERP. We knew there’s no value to going halfway—that wrappers on top of old ERP data models and workflows won’t provide the flexibility or unified data your team needs. So, our team of SAP veterans, who built some of its most successful S4/HANA features, started over, with security in mind and considering AI from the start. We call the result Everest, and our CPA salespeople would be happy to show you how it works.